You can still get a tax credit refund from the IRS, even if you’ve already received PPP loans. This fast ERC eligibility check and rebate application make it easy to claim your maximum allowable refund, even if you didn’t qualify originally.

Did you know that you can still claim rebates for the IRS Employee Retention Credit (ERC) program in 2023?

In fact, now you can claim significantly more tax credits, even if you didn't qualify under the original guidelines - and with the right rebate application, you don't even have to worry about the paperwork.

BottomLine Concepts has an application process that uses a team of financial experts to help you qualify, and claim your maximum allowable rebate, the easy way.

Visit https://bottomlinesavings.referralrock.com/l/ALONSOCOLI58 to find out if you qualify, absolutely free, or to begin your claim.

Research from the National Federation of Independent Business (NFIB) shows that only about a third of business owners are familiar with the ERC program, even though most can qualify for rebates. This is because when it was first announced, you could enroll in either the ERTC or the PPP, but not both.

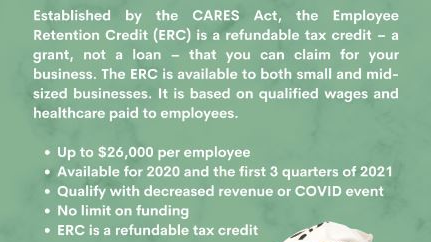

Since the PPP offered more money, faster - it was an obvious choice at the time. Now, however, you can claim ERTC even if you've already applied for and received PPP loans. Unlike the PPP, however, rebates claimed through BottomLine Concepts are not a loan, never require repayment, and have no restrictions on how they can be spent.

That's only one of the expansions the program has gone through, with each one making it easier to qualify, and increasing the maximum allowable rebate. So even if you did not qualify for ERC before, it's worth taking a free eligibility test today, because that might have changed.

Besides, the eligibility test is absolutely free, requires no proprietary business information, and only takes a minute to complete. Even if you're not eligible, you've only lost a minute of your time - and if you do qualify, it could be worth hundreds of thousands of dollars in refunds from the IRS.

To qualify for the program, your business must have had 500 or fewer W-2 employees on the payroll during 2020 or 2021, and been affected by the pandemic in some way. While this is most often shown through financial losses or temporary closures due to government lockdowns, it can also include many situations caused by the pandemic that resulted in a loss of work capacity.

You can also claim rebates if you reduced capacity due to supply chain shortages, public health restrictions, or remote working limitations. The program is open to businesses of all types, including startups, new businesses founded during the pandemic, and non-profit organizations, including churches, schools, and clinics.

The financial team at BottomLine Concepts specializes in helping small and medium-sized businesses to maximize their rebates, using several changes to the ERTC guidelines. While the program initially offered you only $5,000 per employee, BottomLine Concepts can now help you claim up to $26,000 per employee ($10,000 is the average for companies that received PPP).

With no upper limit on funding, Bottomline Concepts has been able to help clients claim up to $6 million in rebates, though the average is closer to $150,000.

One satisfied client said, “BottomLine has terrific leadership and fulfills its promise to add value by contributing to the bottom line of your organization. They promised us positive results, and delivered on their promise.”

If you kept employees on the payroll during the pandemic, even if it was only for a single fiscal quarter, you could be eligible for tens or hundreds of thousands of dollars in rebates.

It's fast, free, and easy to find out if you qualify - the only way you can lose is if you don't make a claim.

Visit https://bottomlinesavings.referralrock.com/l/ALONSOCOLI58 to take the free eligibility test, begin a claim, or learn more about BottomLine Concepts and the ERC program.