Free ERTC Rebate Estimates & Fast Tax Credit Application For SMBs & Non-Profits

Get a free estimate of your ERTC rebate, which could be up to $26,000 per employee. Fundwise can quickly estimate your rebate with no risk, and they can even help you to maximize your funding, and complete the paperwork.

Very rarely, an opportunity will come along that's so good, there's no reason not to take it.

That perfectly describes the ERTC program, which provides one-time payouts from the federal government that are not a loan, have no restrictions, and have no strings attached.

In fact, it's already your money, they're just giving it back in the form of tax credits to help offset unexpected business costs caused by the pandemic.

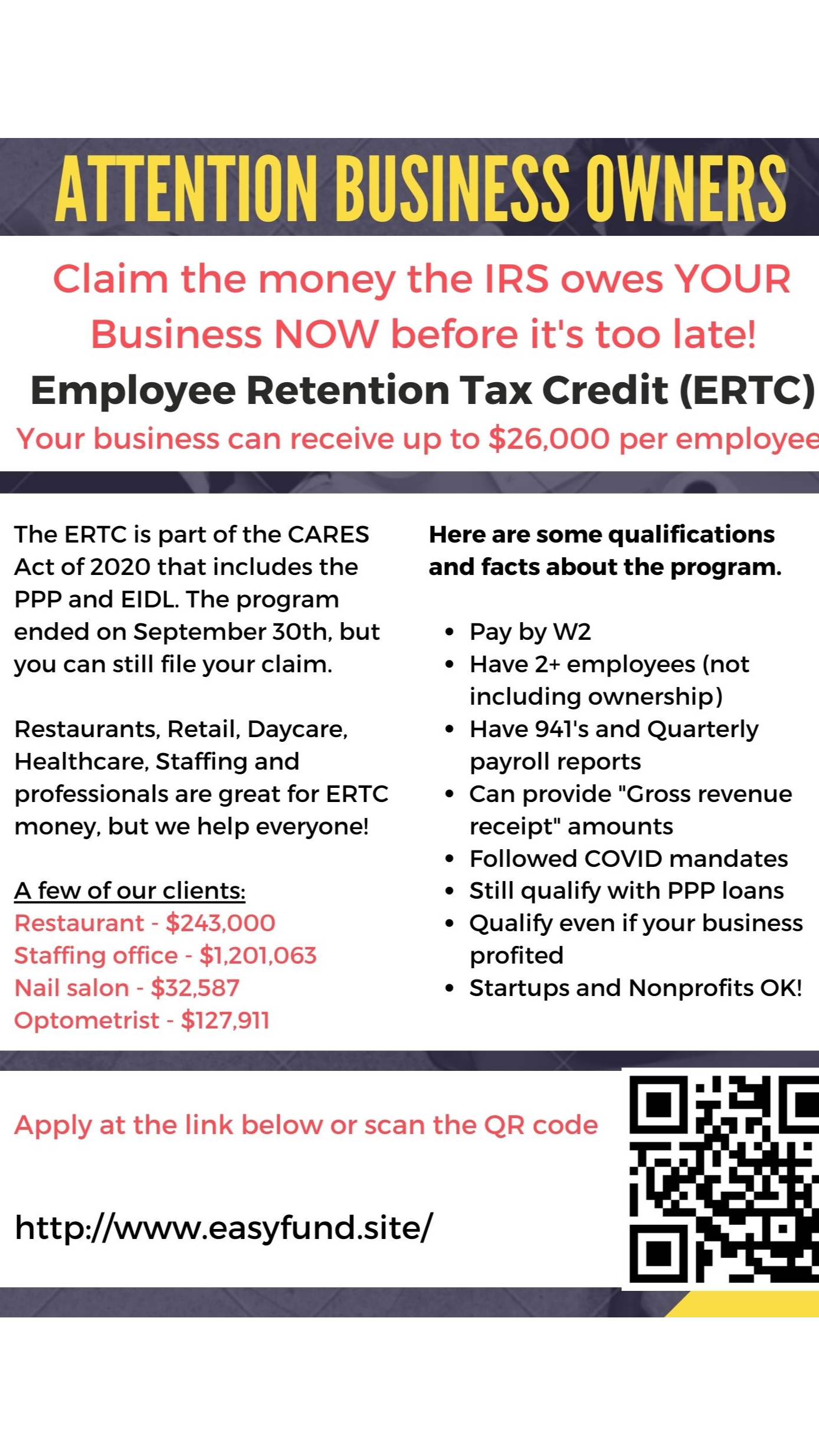

The recent pandemic led the federal government to create several pandemic relief programs for small to medium-sized business owners, including the Employee Retention Tax Credit (ERTC) program. While the program has ended, Fundwise can still help you to claim your rebates for 2020 and 2021.

Visit http://www.easyfund.site to learn more about the ERTC program, and how Fundwise can help to maximize your rebate.

Using the new application program, you can claim up to $26,000 per employee in tax credits, with no restrictions on how the funds can be spent. The program is open to any business with 500 or fewer W-2 employees, including startups, new companies founded during the pandemic, and non-profit organizations such as churches, schools, and clinics.

The Fundwise rebate applications are processed by a team of attorneys, CPAs, and financial experts, with a 90% success rate at claiming ERTC funds. The Fundwise team also provides free, no-risk funding estimates, that can help you to determine how much you can claim before you choose to complete the application.

To qualify for the program, a business must have been affected by the pandemic either through significant financial losses compared to the same fiscal quarter of the previous year, or a reduction in services related to government orders. This may include closing the business temporarily because of lockdowns, or offering reduced services such as limited customer capacity.

Due to several amendments to the ERTC program, Fundwise agents can often help you to claim rebates even if you did not qualify under the program’s original guidelines. Examples include businesses that have already received loans through the Paycheck Protection Program (PPP) or companies that have over 100 W-2 employees.

To receive help from Fundwise agents to maximize your tax credits, you can apply online for a free funding estimate and then choose to have the Fundwise team calculate your maximum allowable rebate. The Fundwise team will also help complete the required paperwork and file it with the IRS, so that your rebate claim can be processed as quickly as possible.

A spokesperson said, “There is no need to pay back the ERTC, and is in a sense, similar to the stimulus check that the everyday taxpayer received. Any business structure under 500 employees can potentially qualify.”

"Once in a lifetime opportunity" is a phrase that's often overused, but it fits this situation perfectly.

If you run a small or medium-sized business, this is your chance to get a significant rebate from the federal government, with no restrictions or repayment - and that kind of opportunity certainly doesn't happen often.

Visit http://www.easyfund.site to get a free estimate of your rebate, or to maximize your claim.