The launch of a new B2B platform that utilizes blockchain has been announced by the Crypto Exchange Alliance (CEA). It is designed to overcome the most pressing crypto issues right now, including improving liquidity, security, and regulation.

Do you want to improve the security of your digital assets? Do you want to improve the liquidity of your cryptocurrencies? Are you interested in learning about a new crypto exchange platform? If you have answered 'yes', this is for you!

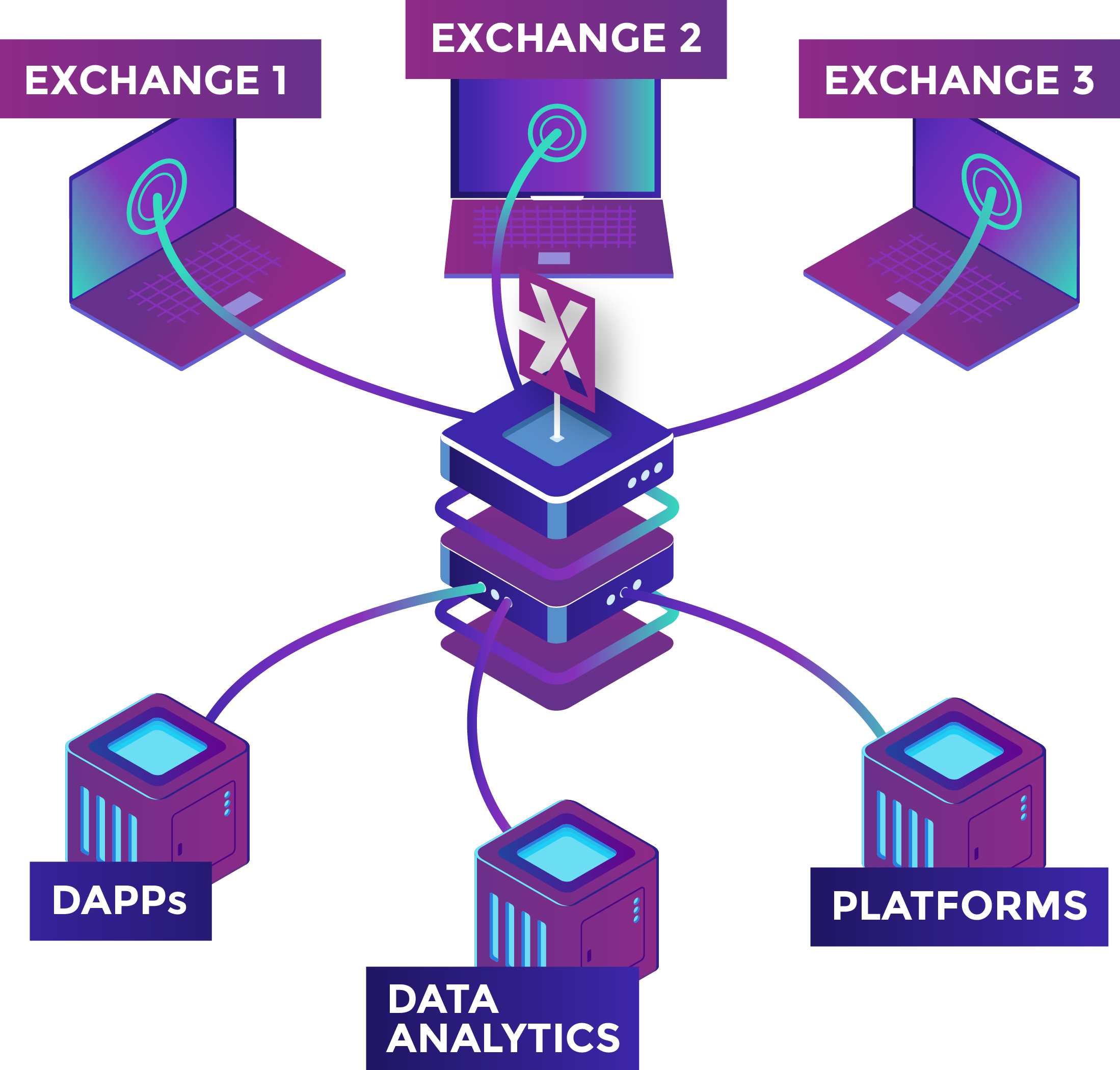

Crypto Exchange Alliance (CEA) has announced the launch of a new platform to solve liquidity issues across exchanges in cryptocurrency. The B2B, enterprise grade software solution will unify exchange order books and autonomously match orders across exchanges.

You can find out more here https://exchangealliance.io

The newly announced platform aims to empower exchanges to access real liquidity from one another to better serve you and your customers while increasing your revenue. This approach enables exchanges to fulfil orders that may otherwise sit on your books or end up costing you money if you engage a market making service.

In case you are wondering, CEA and the expert team behind it suggest the platform they have developed has the potential to unite the industry in a non-competitive way due to the structure of the technology systems operating in the background. This scenario creates a win-win-win situation that will ultimately strengthen the industry and your digital assets.

Furthermore, there are zero upfront fees for CEA’s service, which turns a historically high cost into a revenue for you and other customers. CEA has designed a process by which it plugs into your exchange APIs and aggregates all liquidity into the proprietary CEA Global Orderbook, which is then displayed on your exchange and is visible to your traders.

The cross-exchange order matching engine works to minimize the amount of unfulfilled orders on your books, which therefore maximizes your profit opportunities. The platform has been developed in recognition of the rapidly growing digital asset exchange space. As you may understand, proven infrastructure is required if global adoption is to become a reality.

CEA has created a roadmap with an initial focus on spot trading across centralized exchanges before moving on to futures, derivatives, options, security token exchanges, and then decentralized exchanges. The team believe they have the ability, technology, and tools to support the entire market.

One of the most powerful features of the platform is its proprietary blockchain based Federated Sidechain, which enforces transparency while protecting your exchanges from front-running and re-ordering. It also decreases on-chain transaction fees and records all relevant data into a ledger.

CEA has already overcome one of the biggest issues associated with exchanges - regulation. KYC and AML details can be found in the sidechain because of support from CEA’s strategic partner KYC3’s Peer Mountain Protocol.

A sidechain is a blockchain that runs parallel to the main blockchain, which is coupled with a mechanism that allows data to be transferred between chains with ease.

A company representative said: “The rapid growth of cryptocurrencies and blockchain technology offers you a raft of opportunities if you are an entrepreneur, investor, or tech-savvy person. But the market has become saturated and we would like to see the exchange space democratized to make way for your innovative exchanges to come to market and reach their full potential.”

You can find out more by visiting the website!