How To Buy a Cold Plunge or Ice Bath on Your Health Savings Account Explained

Did you know that cold plunges are HSA-eligible? Learn how to utilize your account in ColdPlungeInsider.com’s new guide!

Guide to Buying a Cold Plunge With Your HSA

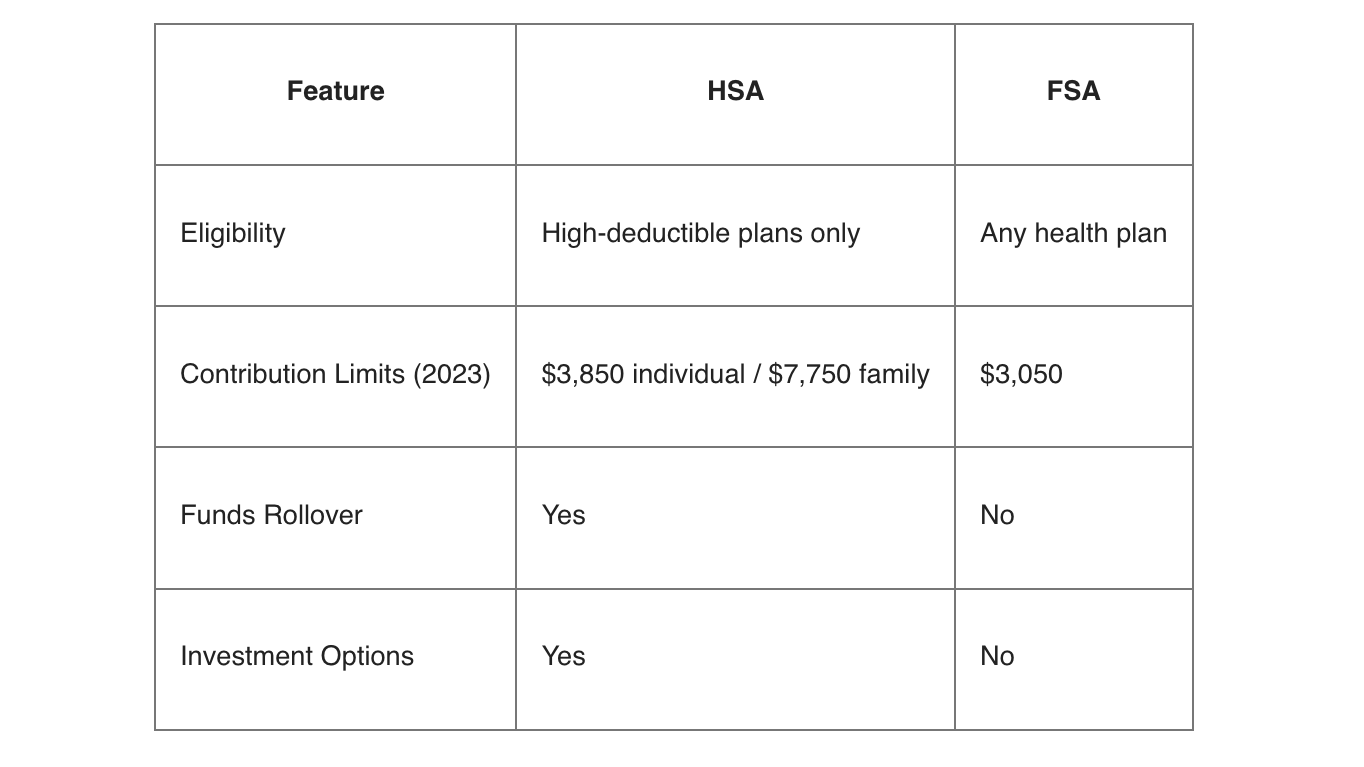

Nothing beats the feeling of a refreshing cold plunge in the morning or after a workout. In ColdPlungeInsider.com's new guide, you'll learn how to reduce the cost of your very own at-home cold plunge by up to 40% with your HSA! The guide goes over the different criteria, the difference between an HSA and an FSA, and how to maximize benefits.

Read the full guide here: https://coldplungeinsider.com/are-cold-plunges-and-ice-baths-health-savings-account-hsa-eligible-2/

HSA Makes Cold Plunging Available to More People

Cold plunging has increased in popularity in recent years, with many health professionals highlighting benefits like reduced inflammation and an improved immune system. If you don’t live close to water or want to be able to take a cold dip even during warm weather, an at-home tub is a convenient solution. However, prices for tubs with an included chiller often start at around $4,000 and (much higher) up.

If deemed a medical necessity, it’s possible to buy a tub without taxes, making it accessible even if you have a restricted budget.

“One of the most compelling reasons to use an HSA is the pre-tax benefit. Contributions to your HSA are made with pre-tax dollars, reducing your taxable income. This means you save money on taxes while setting aside funds for medical expenses like cold plunges,” a company spokesperson explained.

Proven Health Benefits of Cold Plunging

According to NPR, many of the claimed health benefits from cold plunging have not been studied enough. But some studies have proven that acute and repeated cold exposure can contribute to a more balanced blood sugar. For full effect, it requires the body to start shivering and can improve insulin sensitivity better than exercise in some cases. Cold plunging also has the potential to increase metabolic rate by five times and can be useful to treat Type 2 diabetes.

Letter of Medical Necessity

To make a cold plunge HSA eligible, a Letter of Medical Necessity from a healthcare provider will be needed in most cases. The letter needs to be detailed and explain how a cold plunge tub can improve a medical condition for reimbursement to be possible.

ColdPlungeInsider.com explains that another benefit of HSAs is that account holders over 65 can use their funds for non-medical expenses without penalty, with the drawback that they will be subject to income tax.

Learn everything there is to know about how to use your HSA for an ice bath tub at: https://coldplungeinsider.com/are-cold-plunges-and-ice-baths-health-savings-account-hsa-eligible-2/