Are you a small business owner with 5 or more W2 employees? Did you know that with ERC refunds, you could claim up to $26,000 per employee? If not, you need to sign up for Bottom Line Concepts’ webinar and get a no-obligation consultation today!

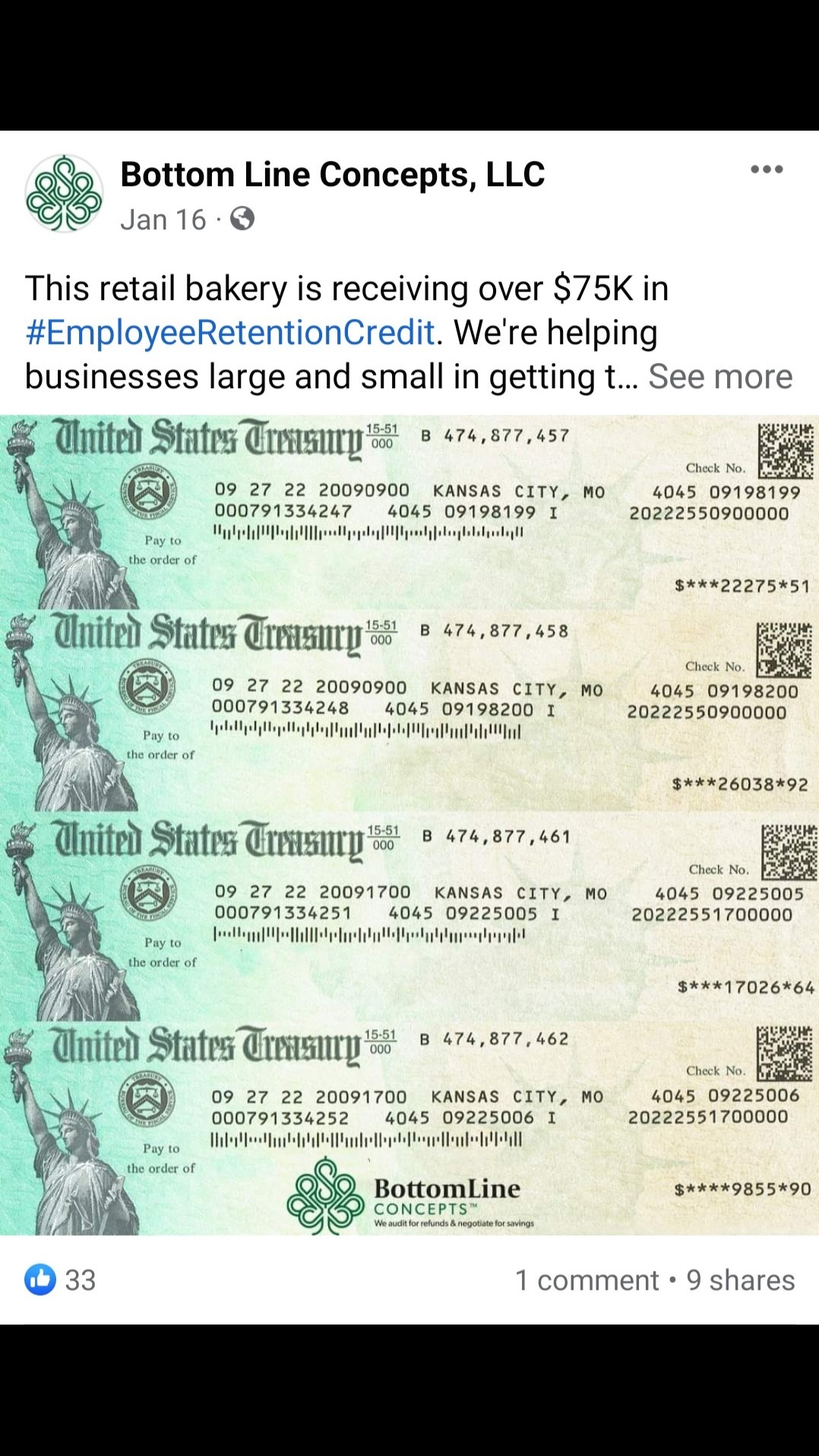

If your business managed to retain employees during the pandemic, you may be entitled to ERC refunds that can directly boost your bottom line. However, without knowledge of the eligibility criteria, you may be unsure if your business qualifies. That’s why Bottom Line Concepts has released an educational ERC webinar.

In the webinar, you will discover how changes to the ERC eligibility criteria opened up claims for more businesses and how the program could provide you with refunds of up to $26,000 per employee.

Moreover, the company also offers consultations with an advisor who can determine the ERC eligibility of your small business as well as guide you through the claims process.

Visit https://www.ercmoneyaccess.com for more information.

During the pandemic, many businesses struggled to retain their employees due to drops in revenue or government shutdowns. However, if you retained your teams despite the financial challenges, you may now be eligible for Employee Retention Credits, regardless of whether you received funding such as from a PPP loan in the past. Bottom Line Concepts’ webinar is helping small business owners like you learn more about what the ERC program is and why you should make a claim.

Presented by Bottom Line Concepts’ CEO Josh Fox, the webinar explains that many business owners may be unsure of making a claim either due to a lack of confidence in their eligibility, or an unwillingness to claim money from the government. However, Josh explains that as the ERC program is a refund rather than a loan, you shouldn’t miss out on this opportunity.

By attending the webinar, you will learn that due to changes in the ERC criteria, many businesses that were previously unable to make a claim are now eligible. Additionally, it outlines that your accountant or financial advisor may not be up-to-date on these changes, making it crucial that you contact a dedicated ERC specialist to check your eligibility.

Following attendance to the webinar, you can arrange a free 10-minute consultation with one of Bottom Line Concepts’ specialists. During these consultations, the ERC advisors can determine if you can make a claim, and how much you may be owed, as well as provide professional support on the next steps should you qualify.

A spokesperson for Bottom Line Concepts said, “Our dedicated experts will guide you and outline the steps you need to take so you can maximize the claim for your business.”

Don't waste time. Learn how much money your small business is owned with Bottom Line Concepts’ educational ERC webinar!

Get full access now at https://www.ercmoneyaccess.com