Non-Profit Employee Retention Credit Application & ERTC Eligibility Test 2022

Get up to $26,000 per employee in tax rebates from the IRS, that you never have to pay back. It’s fast, risk-free, and backed by an expert team of CPAs – all you have to do is apply before it’s too late.

When was the last time you received a check in the mail from the IRS?

I know, you're probably thinking it doesn't work that way, YOU send THEM money, not the other way around. Right?

Not this time - at least not if you've claimed your ERTC rebate.

Business owners across the country have been receiving checks ranging from a few thousand dollars, to over $6 million - with no strings attached.

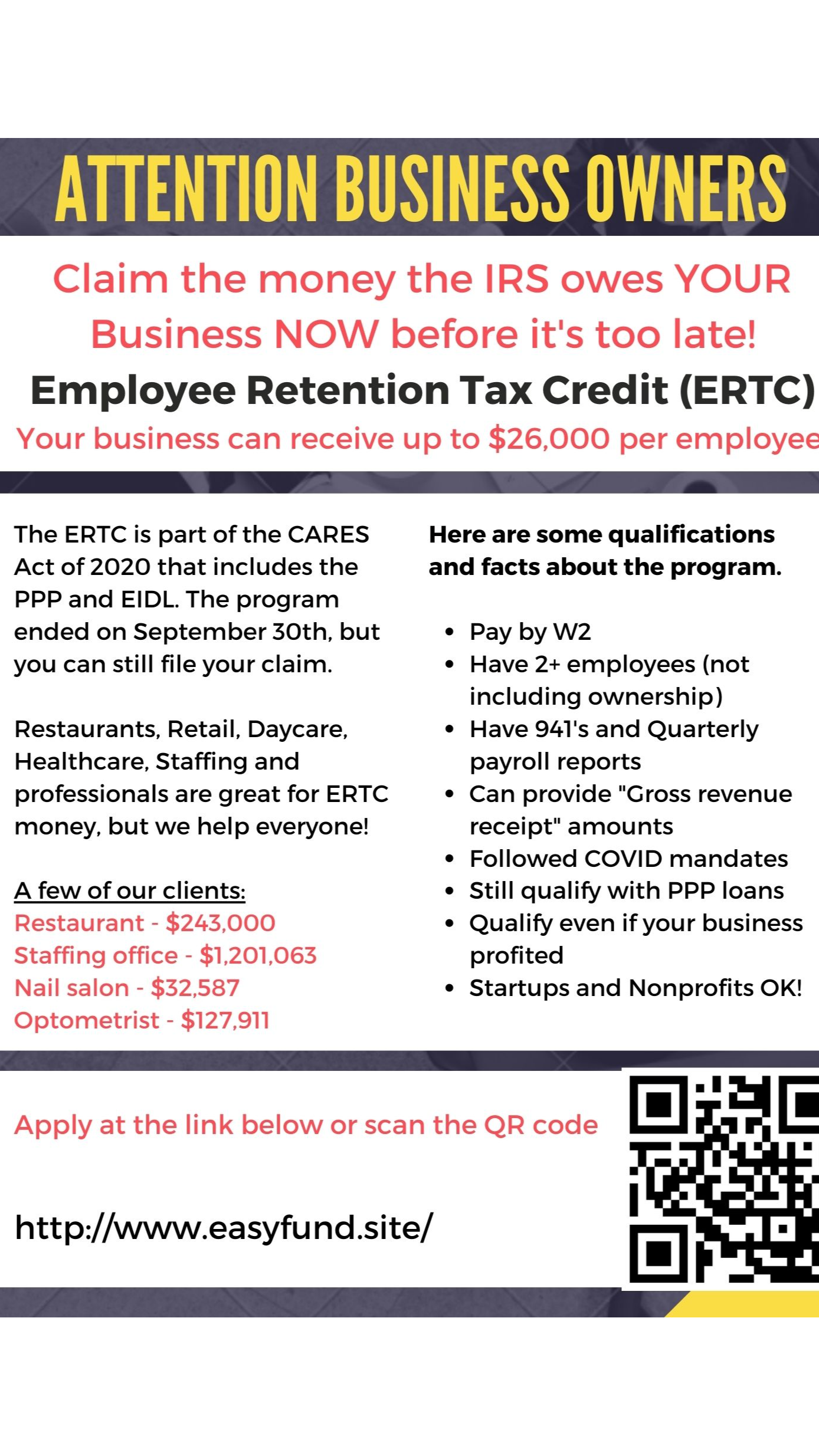

While you've probably heard of the Paycheck Protection Program (PPP) and the Employee Retention Tax Credit (ERTC) program, many employers are unaware that it is possible to claim relief funds through both. A new rebate service from Fundwise can help you to claim up to $26,000 per employee, even if your business has already received loans through the PPP.

Visit http://www.easyfund.site to learn more about the ERTC program, how it's changed, and how much you can claim.

Originally, you could only enroll in one relief program or the other, but new amendments to the CARES Act have expanded the eligibility to allow your business to benefit from both programs. The new rebate service can help you to claim ERTC rebates for any industry, including startups and non-profit organizations.

With the new online application, you can receive a no-cost estimate of your rebate by answering a few simple questions. The ERTC team can also help to calculate the maximum allowable rebate for each business, complete the required paperwork, and ensure that it has been filed with the IRS.

The new program is provided 100% risk-free to any employer with fewer than 500 full-time W-2 employees. Funding estimates are available with no cost or obligation, and any company that applies but does not qualify or does not receive a rebate will not be charged.

Though the PPP and ERTC were created at the same time and for the same reason, the two programs take very different approaches. While the PPP provided small loans with several restrictions, the ERTC provides a one-time payout that never has to be repaid, and carries no restrictions on how it can be spent.

The rebate service includes a totally free eligibility test for small and medium-sized businesses, startups, and non-profits, including churches, schools, and clinics. The assessment can be completed in approximately one to two minutes, without requiring any proprietary business information.

ERTC applications are handled by a dedicated team of CPAs, attorneys, and financial experts, with the goal of maximizing each business’s tax credits quickly and accurately. While not every applicant will qualify for a rebate, the service currently has a 90% success rate.

There's no risk, no up-front fees, and no repayment - so there's no reason not to apply.

At the very least, take the free eligibility test and find out how much you're eligible for, it only takes a minute.

Visit http://www.easyfund.site to claim your rebate today.