Traders are always looking for an “edge.” Proper position management can overcome even a poor win rate. The study illustrates how and when traders exit can significantly impact trading results.

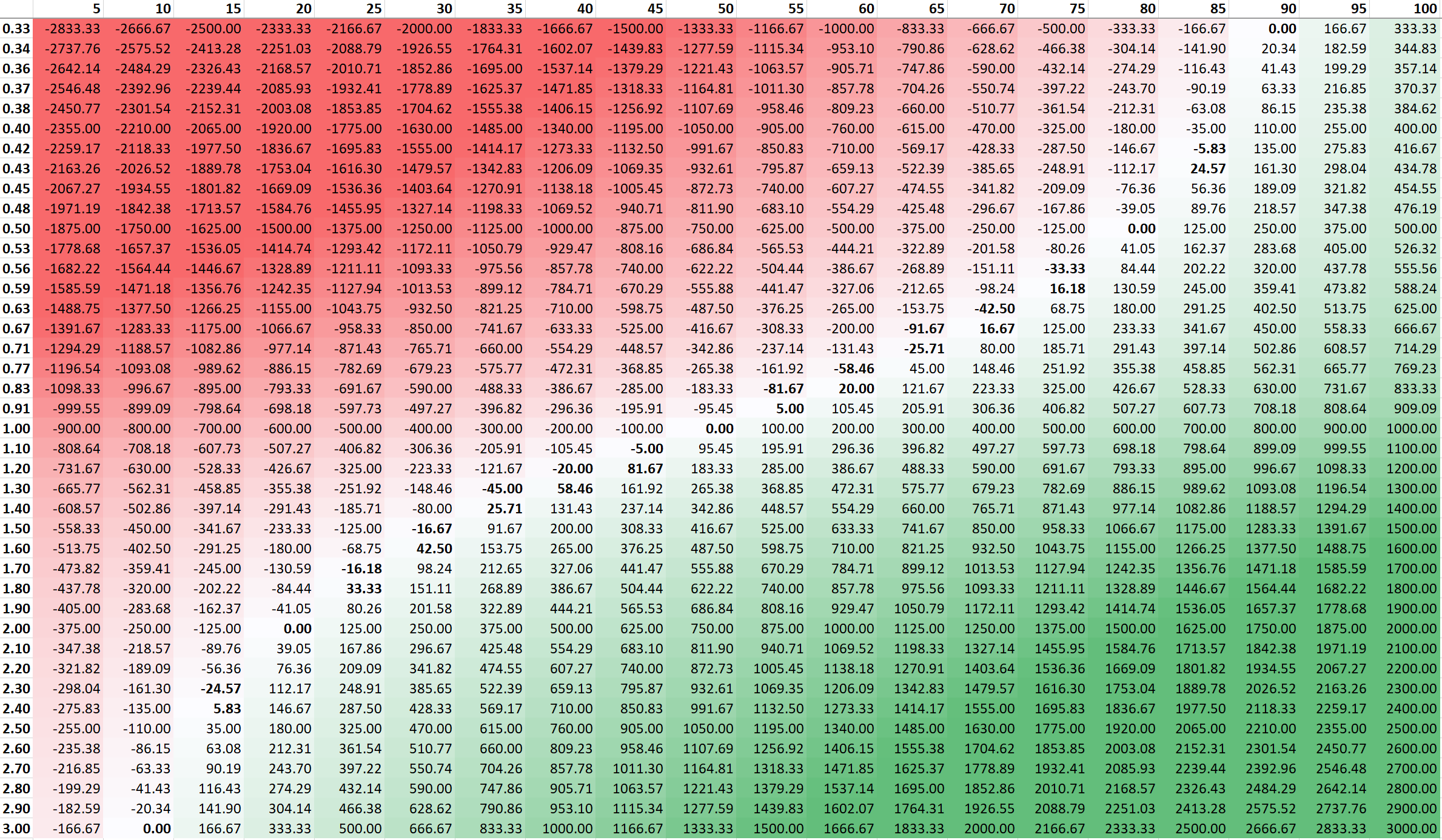

Grey Matter, LLC revealed their case study assessing the proposition that small losses can provide an actual trading edge. This case study explores precisely whether, through a purely mathematical, objective analysis of win rate versus win:loss size ratio, keeping losses to a minimum can affect a trader's overall results.

The case study also explores these two degrees of freedom, win rate and win:loss size ratio, in trade performance and determines the easiest path to superior trading results. The study also considers the time spent in a trade, which is shown to have a direct correlation to profitability.

When a trader enters a trade, they have the ability to control the amount they put at risk, but this study holds that size constant. As the study suggests, once in the trade, the trader controls only when to exit. Only the market and not the trader has control over the direction in which price moves. While the win:loss ratio is somewhat dependent upon the trading methodology, if market movement is considered a random walk, then the only level of control that the trader holds is the size of wins and losses at their exit. This study considers the impact of this decision on overall results.

Grey Matter, LLC owner Lee Grey understands that all traders are looking for a legitimate trading edge. This case study reveals in a practical and implementable way what is truly within the trader's control. The content is simple and easy to understand. It is also surprisingly easy for a disciplined and motivated trader to put into practice. Most traders will find that the largest impediment to benefitting from this very real edge is their own psychology.

The case study is available at http://blogspot.tradeunafraid.com/2021/05/small-losses-are-your-trading-edge.html

About Grey Matter, LLC

Grey Matter, LLC was founded in 2016 and offers a powerful and unique tool for stock and option traders. This trading platform, Trade Unafraid, enables traders to improve their speed, discipline, and market reach through automation and superior controls.