Azoras has launched a new report explaining the most expensive personal finance mistakes young people should avoid. The team explain investing early means people have more time to earn a return.

Do you have good money habits? Are you aware of the costliest personal finance mistakes you can make while you are young? Do you want to avoid them or change your bad money habits? If you want to make a positive change today, this is the report you need to read!

A company that utilizes a FinTech app to help you manage your mortgage through an all-in-one platform has launched a new report on the most expensive personal finance mistakes you should avoid while you are young. The team at Azoras explain the financial mistakes you make early on can have consequences for the rest of your life, particularly when you need to access credit for a house or car.

You can find out more information at https://www.youtube.com/watch?v=mprkhuDPuBw&ab_channel=Azoras

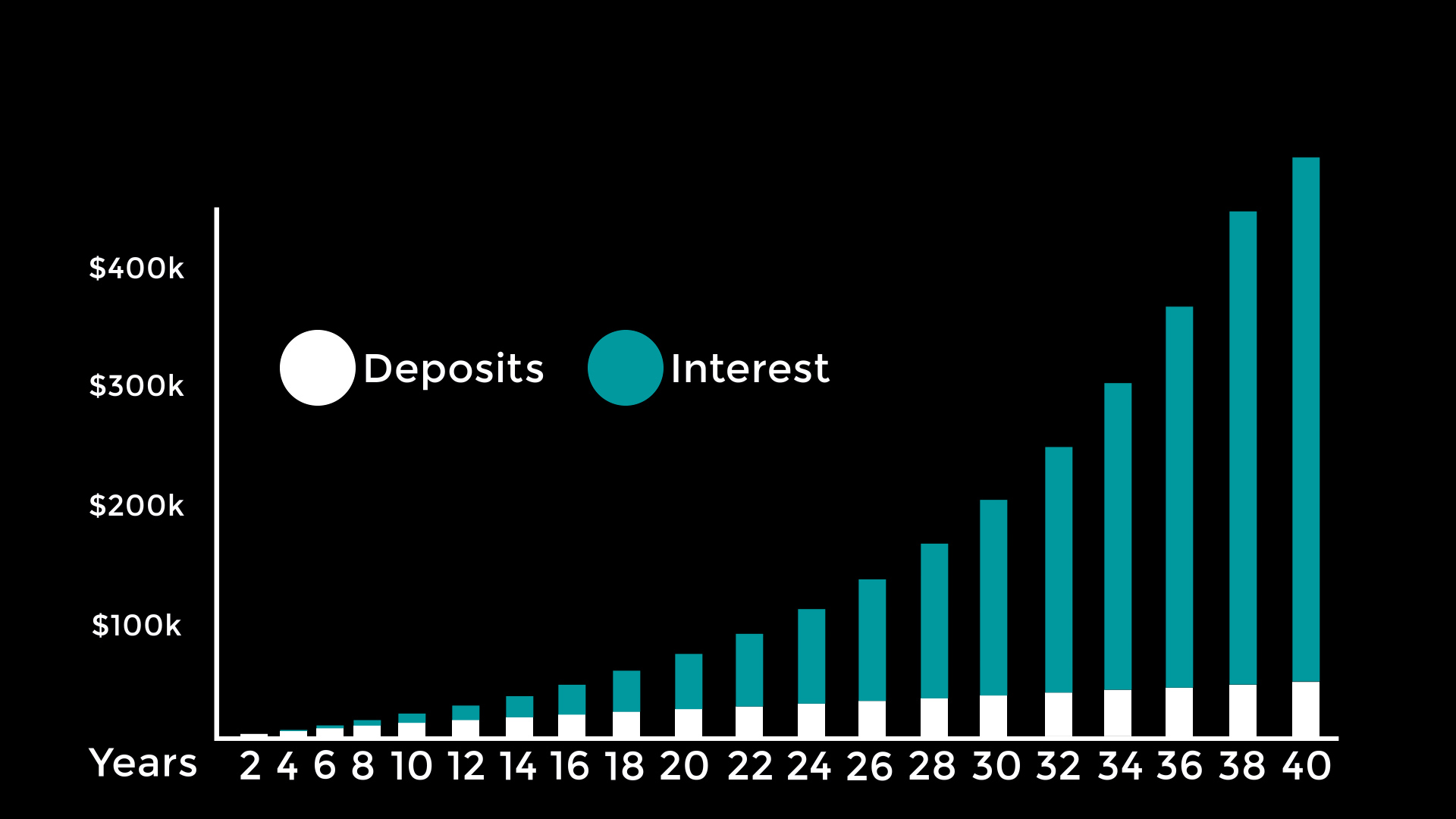

The newly launched report focuses on the five biggest mistakes you may make while you are young and includes waiting to invest. The team at Azoras explain the younger you are when you start investing, the longer you can earn a return on your investment. They add that compound interest is one of the best reasons to start investing as early as possible.

Not having a private pension is the second most costly mistake say the team. They explain that if you are based in the UK, you may be unaware of pension tax relief and how it works, which means you are likely missing out on funds.

Azoras explains for every contribution you make to a private pension with a verified provider, the government adds 25% of that figure. If for instance, if you add £100 per month, you will receive a £25 top-up from the government.

Not budgeting is the quickest way to get yourself into debt explains the report. It says sitting down and creating a realistic budget for the week or month and sticking to it can save you from wasting your money on impulse purchases and things you do not need.

Expensive cars can impact your ability to save says Azoras, as there is not just the car payment to consider, but the cost of insurance, tax, fuel, and maintenance. The team add that long-term loans may appear low-cost each month, but they add up if you calculate the full term.

A representative said: “The fifth and final personal finance mistake to avoid is getting a credit card. If you are disciplined enough not to abuse it, there is no problem, but many people do not have this discipline. With typical interest rates over 17%, you do not want to accumulate credit card debt.”

You can find out more via the link provided! Alternatively, you can visit the main company website at https://www.azoras.co.uk.